Q3 2022 Jackson Hole Market Report

The Jackson Hole real estate market is in a transitionary period. While experiencing upward pricing trends for the past 5 years, will prices be able to grow further when faced with a dramatic decrease in demand?

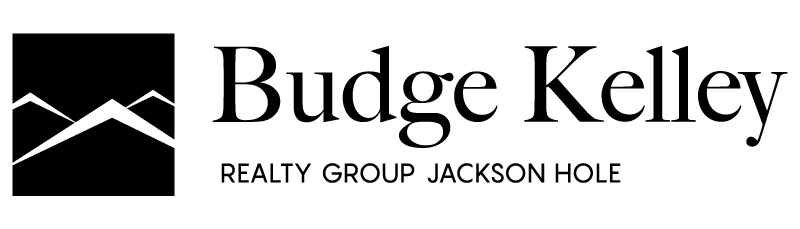

Across all segments of Jackson Hole’s real estate, the number of transactions has fallen 51% driven by buyer apprehension of quickly rising interest rates, inflationary pressures, and global uncertainty. A trifecta that has cooled the heels of even the most optimistic buyers. Nonetheless, the year-over-year data indicates prices have not been affected in Jackson Hole – yet. The overall average sale price increased 9% and the median sale price rose 30% compared to the same period last year. The contraction of buyer demand has led to an increase in inventory across all property segments. This has allowed buyers to take their time, negotiate harder, and be pickier. However, even with a 28% increase in inventory, Jackson’s real estate market is far from having an oversupply that would drive pricing down.

All market transitions take time and only time will tell where prices are headed, but right now there are few examples of price declines. Jackson Hole will remain an alluring destination for visitors and residents alike, and the finite amount of land here means supply and demand will always be skewed. In the long run we unequivocally believe investing in real estate will be rewarding regardless of the market conditions. Reach out to Chad, Dianne, or Rebekkah anytime to discuss how we can help you with your real estate goals.